|

|||

|

|

|

||

|---|---|---|

|

||

|

||

|

||

|

||

|

||

|

||

|

|

|

|

Exploring Mobile Home Financing Options in OhioMobile homes provide an affordable housing solution for many Ohio residents. Financing these homes, however, can be complex due to their classification as personal property rather than real estate. Understanding your options and preparing accordingly can make the process smoother. Understanding Mobile Home LoansMobile home loans can differ significantly from traditional mortgages. It's essential to know the types of loans available to make an informed decision. Types of Mobile Home Financing

Key ConsiderationsWhen choosing a loan, consider the following:

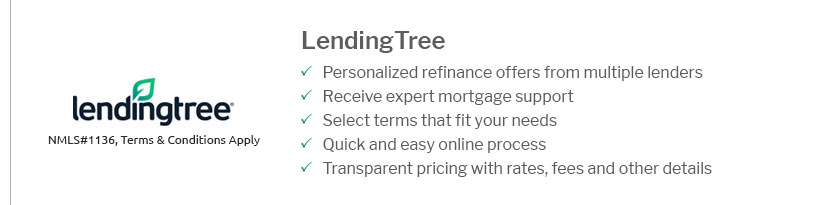

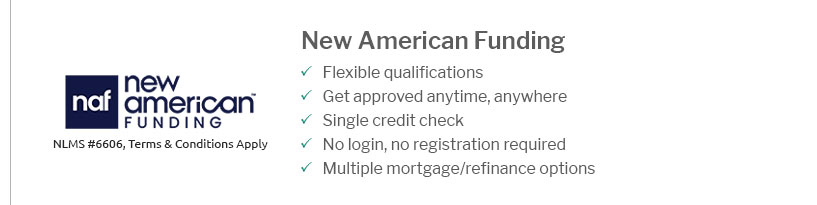

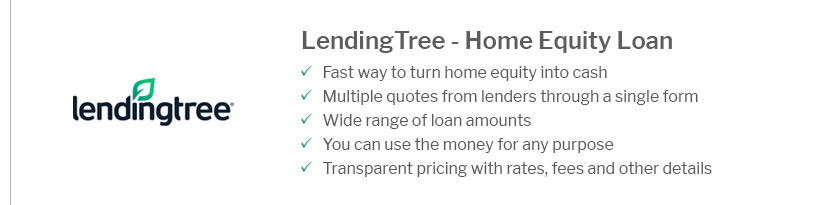

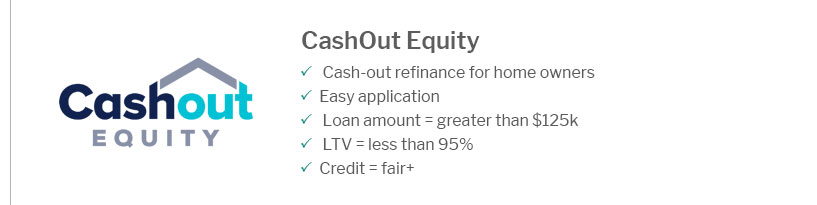

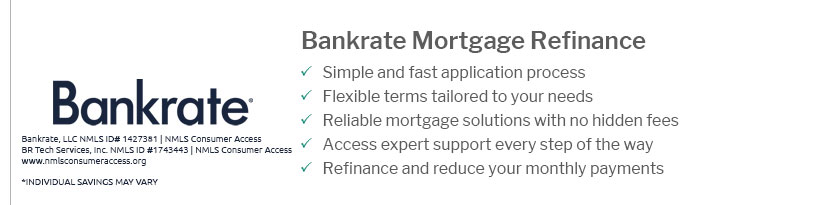

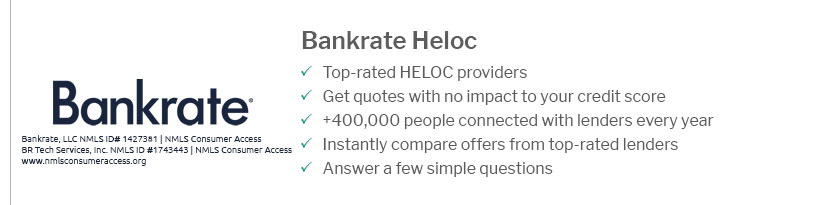

For those considering refinancing options, you might explore opportunities to refinance with a new lender to potentially secure better terms. Navigating the Ohio MarketOhio offers diverse options for mobile home communities, from urban areas to rural settings. Each comes with its own set of regulations and financing implications. Location and ZoningUnderstanding the local zoning laws is crucial as they can impact financing options. Some areas might restrict where mobile homes can be placed, which could affect loan eligibility. Community AmenitiesMany mobile home parks in Ohio offer amenities such as pools, clubhouses, and playgrounds. While attractive, these can also influence the cost of living and should be factored into your financing plans. Preparing for the Financing ProcessPreparation is key to securing a favorable mobile home loan. Here are steps to enhance your readiness: Improving Your Credit ScoreA higher credit score can lead to better loan terms. Consider paying down debt and correcting any errors on your credit report. Using Financial ToolsTools like the mortgage calculator nj can help you estimate potential loan payments and budget accordingly. Frequently Asked Questions

https://capitalhomemortgage.com/Ohio/manufactured-home-loans/

We offer specialized financing programs tailored to your needs, whether you're interested in traditional manufactured home financing or chattel loans. https://www.ohmanufacturedhomes.com/lenders/

Check out the listings below to find a lender in Ohio that can help you find the right manufactured home loan. http://www.hud.gov/program_offices/housing/sfh/title/repair

Under Title I Manufactured Home Loan Program, FHA approved lenders make loans to eligible borrowers to finance the purchase or refinance of a:

|

|---|